Key Takeaways

USEP prices in Singapore remain low in 2025 due to EMA’s stabilisation measures, which limit volatility and cap price spikes. For solar homeowners on OEM and ECIS, this means lower and more unpredictable export earnings. Switching to SP Group’s regulated tariff offers more stable bills and predictable solar rebates in today’s low-USEP environment.

Solar homeowners in Singapore have the choice between two payment schemes for exporting solar electricity to the grid. If you’re a solar homeowner signed on to an Open Electricity Market (OEM) retailer, you may have already noticed that your solar export rates have dropped significantly in the past year.

You’re not imagining things. Electricity prices in Singapore’s wholesale market — specifically the Uniform Singapore Energy Price (USEP) — have been trending downward for several quarters. This directly impacts homeowners under the Enhanced Central Intermediary Scheme (ECIS), where your export earnings are tied to the prevailing USEP.

So what’s happening in 2025? Will USEP eventually rebound? And what should solar homeowners do now to protect their savings? Let’s break it down.

Quick Refresher: What is USEP?

USEP stands for Uniform Singapore Energy Price. It is the half-hourly electricity price in Singapore’s Wholesale Electricity Market (SWEM) and is influenced by:

- Real-time supply and demand

- Fuel prices (mainly natural gas)

- Power plant capacity and outages

- Market conditions and regulation

When demand spikes or supply tightens, USEP rises. When supply is stable and demand is moderate, USEP falls — which is exactly what’s been happening from 2023 to 2025.

Why Are USEP Prices Still Low in 2025?

Starting July 2023, the Energy Market Authority (EMA) introduced a series of measures aimed at stabilising the electricity market. These policies continue to shape USEP levels today.

1. Temporary Price Cap (TPC)

The temporary price cap (TPC) is a mechanism that activates when prices spike excessively, preventing prolonged and extreme peaks.

This reduces volatility, but also limites the upside for USEP.

2. New Vesting Framework (2023-2028)

EMA introduced a new vesting regime that requires generation companies (gencos) to commit part of their generation to SP Group at pre-determined prices. This reduces opportunities for price manipulation and keeps wholesale prices more predictable.

Combined, these measures have pushed USEP toward a more stable, but lower range in 2024 and 2025.

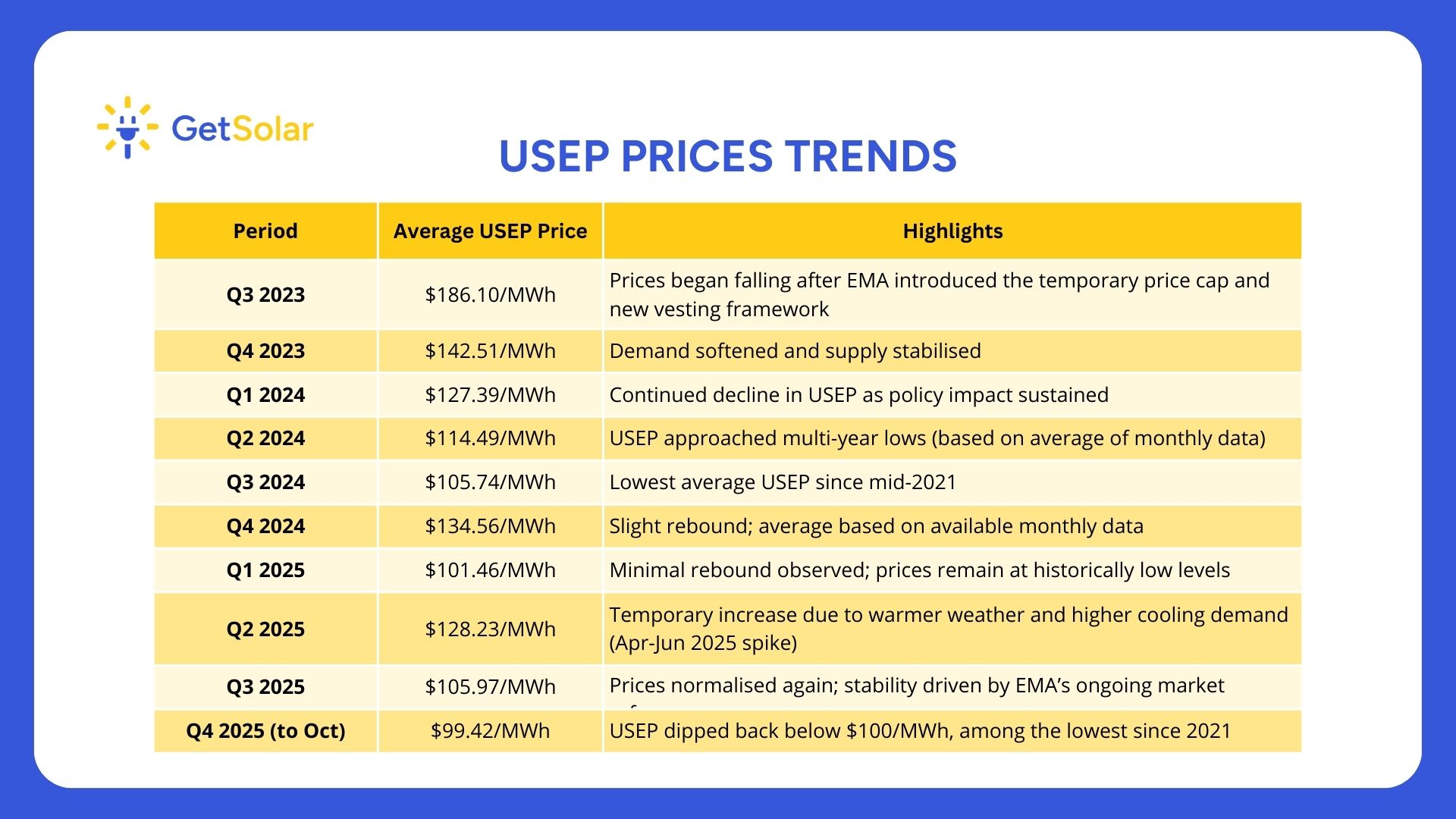

What Are the USEP Trends Like from 2024 to 2025?

Below on the latest monthly averages, USEP in 2025 remains low and relatively stable, with prices hovering close to below $110/MWh for most of the year.

Here’s how the average USEP prices have changed over the past quarters since 2023:

What Does This Mean for Solar Homeowners?

If you are signed under ECIS (typically with an OEM retailer other than SP Group), your solar export price is tied directly to USEP.

That means:

- When USEP falls, your export earnings drop

- When USEP rises, you earn more but EMA's policies are limiting sharp increases

As a result, your solar export price is now lower and more volatile than during 2021-2022. This is why many solar households are seeing much smaller export credits today.

Our Recommendation (Updated 2025): Consider Switching to SP Group's Regulated Tariff

Given current conditions, switching to SP Group may offer more stable electricity costs and more predictable solar rebates.

SP Group Regulated Tariff (as of Q2 2025):

- 28.12 cents/kWh (before GST)

- 30.65 cents/kWh (with GST)

SP Group SCT Export Rate (Q2 2025):

- 21.87 cents/kWh (before GST)

Under SP Group’s Simplified Credit Treatment (SCT) scheme, solar export earnings are predictable and revised quarterly unlike USEP, which changes every 30 minutes. This stability makes SP Group the most practical choice for most solar households in 2025.

How to Switch to SP Group

If your contract with your current retailer is coming up for renewal, switching to SP Group is a straightforward process.

Just remember to submit a new Net Export Rebate (NER) form through your retailer — your solar installer will usually be able to assist with this step. For GetSolar customers, simply reach out to us and we'll sort this out for you!

Other Plans Worth Considering

Depending on your household’s usage pattern, you may explore:

- Fixed price plans from reputable retailers like Tuas Power, Senoko Energy, or Sembcorp Power for long-term certainty.

- Time-of-use plans such as PacificLight's peak or off-peak offerings

However, as long as you remain with an OEM retailed, your solar export price will continue to track USEP — which is volatile and currently low.

Not a Solar Homeowner Yet?

Even with low USEP, solar remains a strong long-term investment.

Why?

- You offset grid electricity at regulated or fixed retail rates

- You protect your household from market volatility

- You reduce your carbon footprint

- You increase your home's energy independence

GetSolar makes going solar simple. Our Solar Assessment Tool gives you a personalised, instant estimate of your savings.

You can also explore flexible payment plans, including Rent-to-Own options with zero upfront cost.

Final Thoughts

Singapore’s electricity landscape is changing and adaptability matters. USEP is likely to remain in a low and stable band for the foreseeable future due to EMA’s stabilisation measures. For solar homeowners under ECIS, this means decreasing export earnings.

But the good news? You still have control. Switching to SP Group or choosing a suitable fixed-price plan can protect your savings and deliver greater predictability.

And if you’re not yet a solar homeowner, now is still an excellent time to take the first step toward energy independence.

Rent-to-Own Solar for Business with Guaranteed Performance

Immediate ROI

Rent-to-Own Solar. $0 Upfront cost. Guaranteed Savings

(10-Year RTO plan)

+ 10-Year Free Maintenance

%20How%20Singapore%20Green%20Plan%202030%20supports%20solar%20adoptions.png)